New figures show what those saving for retirement are aiming for. But will they achieve the lifestyle they want… or will some fall short?

New research from online pension provider PensionBee has revealed a worrying knowledge gap among some Brits when it comes to the critical question: “How much money will I need in retirement?”.

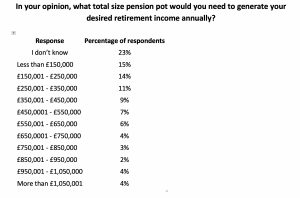

In survey of 1,000 working-age UK adults, nearly a quarter (23%) admitted they were unsure of the total pension pot size they would need to achieve their desired retirement income.

The next most common response (15%) was “less than £150,000”. According to the Pensions and Lifetime Savings Association’s (PLSA) Retirement Living Standards, a pension pot of £150,000 could only fund a “minimum” retirement standard for around 10 years – covering all basic needs but allowing little room for extras.

Fewer than half (49%) of respondents estimated they would need a total pot of around £250,000 or more: the sum necessary to sustain a basic retirement for longer than the 15-year average length of time we spend in retirement.

This suggests many savers may be underestimating the true cost of retirement and risking a pension shortfall.

So how much do people think they will need in retirement?

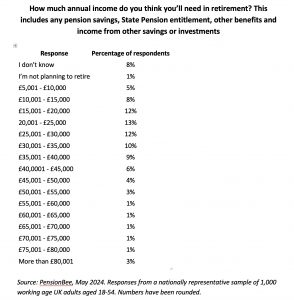

Responding to the survey, the top three responses clustered around an annual income of £15,000 to £30,000 – which falls short of the PLSA’s “moderate” standard, in which retirees would see their annual food and clothing budget increase, in addition to a two-week holiday in Europe as well as a long weekend in the UK every year.

Only 15% of respondents indicated a desired income of over £45,000 a year, exceeding the PLSA’s “comfortable” standard, in which retirees would see their annual food and clothing budget increase again, in addition to a two-week holiday in the Mediterranean, with a budget to replace their kitchen and bathroom every 10 to 15 years and car every three years.

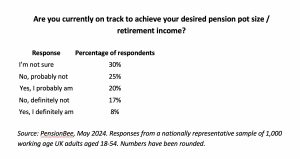

When asked if they felt on track to achieve their desired retirement savings, almost half (43%) of adults said that they didn’t feel on track with their retirement savings. More respondents felt unsure about their progress (30%) than confident they were on track (27%).

The charts below show how much people think they will need to save, and how much they plan to be spending.

So are YOU on target for your desired retirement income?

Finding that out – and so being able to take early steps to get back on course if not – could not be easier by using your RetireEasy LifePlan. You can then run different scenarios to see how (for instance) your plans would be affected if you saved more each month, were to retire later, receive an inheritance or downsize.

If your subscription has lapsed, you can get it back up and running for just a few pounds a month. If you are new to RetireEasy, why not experience the comforting feeling of knowing precisely how much you can spend in retirement by subscribing.