March marked the tenth anniversary of the announcement of “Pension Freedom and Choice” reforms which, along with Auto-Enrolment, represented the two major shifts in pension policy enacted under George Osborne. What have been the long-term impacts for savers? asks Tony Watts OBE.

Up until then, savers reaching retirement were all channelled down the annuity route. Safe… but during times of annuity rates, hardly exciting. Instead, as from April 2015, those over 55 were free to invest their pension cash however they liked – and enjoy a tax-free withdrawal on 25 percent of it if they chose to do so.

The flippant remark from Steve Webb about savers having the freedom to go out and buy a sports car if that was what they wanted to do was not necessarily what the Lib Dem coalition at the time had in mind, but it did embody the free(er) spirited nature of the new rules.

So free in fact, that the plans were pushed through at pace with little or no input from the pensions industry, leading to criticisms at the time that the move was one borne (at the very least in part) of political ideology.

Allowing millions of people to draw down some of their savings ahead of retirement was just as important a break with tradition as being able to choose to invest in plans other than annuities. And in the subsequent years, over £70 billion has been drawn down in this way.

That trend, if anything, is increasing, under pressure at least in part from the cost of living crisis. The average value of taxable flexible withdrawals from pensions increased by 18 percent year-on-year in the first quarter of last year – including some people withdrawing retirement savings over the 25 percent tax-free lump sum threshold and paying dearly for the privilege.

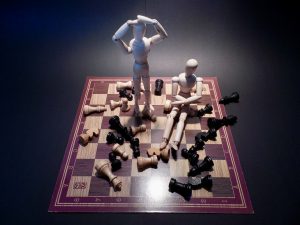

While an injection of cash ahead of retirement may well have been a life saver for some, anyone who has dipped into their funds for luxuries or creature comforts has run the risk of later facing a shortfall in their retirement income. According to Tom Selby, director of public affairs at AJ Bell. “Handing people total freedom over how they spend their own money also comes with risks and challenges. Anyone who takes too much, too soon from their retirement pot will run the risk of exhausting their funds too early.”

A shortfall in advice

At the time, George Osborne promised that anyone wondering what they should do with their new-found freedoms would be offered “free, impartial, face-to-face advice” from Pension Wise, which always appeared to me as a fairly basic-level service. But it was plain that many did not even do this – especially those with smaller pots who also didn’t want to pay for independent advice. Members of some major schemes – notably the British Steel Pension Scheme did get professional advice – but lived to regret the quality of it…

Adds Helen Morrissey, head of retirement analysis at Hargreaves Lansdown: “People are far more grown up than they were given credit for, and they access their cash sensibly. A decade is far too short a time to truly measure the success or otherwise of these measures, but one thing they certainly did was galvanise people’s interest in their retirement savings – it gave people much more of a sense of ownership of their pensions.”

But there’s no question that many savers have benefited from being able to choose where to place their hard-earned savings rather than going down the annuity route, which has certainly had its ups and down since then – particularly if they have availed themselves of expert advice before doing so. “Free pensions guidance” was meant to be a key part of these reforms, but still too few people access this, or are prepared to pay for independent financial advice.

Find out your retirement future

Are YOU on track for a moderate or even a comfortable retirement? Perhaps you’d like to know how much YOU need to save to provide you with a financially secure retirement – whether you own your home or rent? Or how much you will be able to spend each year based on your current savings targets?

You can find out the answers in minutes using your RetireEasy LifePlan.

You can even run different scenarios to see at a glance how the sums change if your circumstances change, or if you decide to save (or spend!) more or less than you had originally planned.

If your subscription has lapsed, just a few pounds a month will get it back on track.